In today’s fast-moving business world, managing your accounts, invoices, and GST filings manually can be stressful. Most small business owners in India still depend on spreadsheets or paper-based records. But that often leads to errors, missed GST deadlines, and confusion during audits.

That’s exactly where cloud-based GST accounting software steps in — it makes accounting easier, faster, and more reliable for small businesses in India.

In this article, we’ll explore what cloud accounting really means, why it’s perfect for Indian SMEs, and how choosing the right GST-ready software (like MyBillZone) can completely change the way you handle your business finances.

💡 What Is Cloud-Based Accounting Software?

“Cloud-based” means your accounting software is hosted online instead of being installed on your desktop. You can access your data anytime, anywhere — all you need is an internet connection.

So, whether you’re at your office, home, or even traveling, you can check invoices, track payments, and monitor cash flow with a few clicks.

Everything — from your sales, purchase, GST invoices, reports, to expenses — stays securely stored on the cloud.

🇮🇳 Why Cloud Accounting Is Perfect for Small Businesses in India

For small business owners in India, especially those managing limited teams or working from multiple locations, cloud accounting offers huge benefits.

Here are some key reasons why cloud-based GST accounting software in India is a game changer:

GST Ready from Day One

The software automatically applies the right GST rate to each product or service and generates GST-compliant invoices instantly. No manual calculations, no errors.

Access from Anywhere

Whether you’re in Delhi, Mumbai, or a small town, you can access your accounting dashboard on your laptop or phone — 24/7.

Real-Time Collaboration

Your accountant or team members can log in and work together in real-time without sending files back and forth.

Automatic Backups & Security

Cloud servers store your data securely and take daily backups — so even if your device crashes, your records stay safe.

Save Time & Money

Forget complicated installations or expensive licenses. Most cloud accounting platforms in India charge affordable monthly or yearly fees.

📊 Key Features to Look for in a Cloud-Based GST Accounting Software

When choosing the right accounting software, focus on features that suit Indian businesses.

Here’s a checklist you can use:

- ✅ GST-ready invoicing and e-invoicing

- ✅ Automatic tax calculation and filing support

- ✅ Expense tracking and profit/loss reports

- ✅ Inventory management for products and stock

- ✅ Client and supplier management

- ✅ Cloud backup and data encryption

- ✅ Multi-user access with role-based permissions

- ✅ Mobile access and WhatsApp invoice sharing

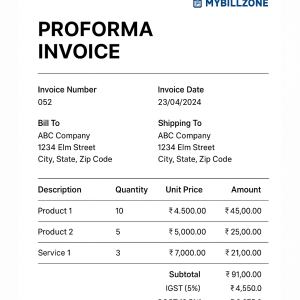

🧾 Example: MyBillZone – Smart Accounting for Indian SMEs

One software making accounting simple for Indian small businesses is MyBillZone — a modern, cloud-based GST accounting tool designed for Indian startups, shop owners, and service providers.

Here’s what makes it stand out:

- 🇮🇳 100% GST-compliant for Indian tax rules

- 💻 Cloud-based dashboard accessible anywhere

- 📱 Easy-to-use interface for non-accountants

- 💸 Affordable pricing — ideal for small business owners

- 🔒 Safe and secure data storage

- 🧾 Tools like invoice maker, quotation generator, and expense tracker

With MyBillZone, even small shopkeepers, freelancers, and wholesalers can manage invoices, record payments, and check reports without needing an accountant full-time.

If you’re looking for cloud based GST accounting software in India for small business, MyBillZone is a great option to explore.

Visit MyBillZone.com to try their free demo.

⚙️ How Cloud Accounting Helps You Stay GST Compliant

Filing GST returns is one of the biggest challenges for small Indian businesses. Missing a deadline or entering wrong tax data can lead to penalties.

Cloud accounting software automatically syncs your invoices, calculates taxes, and prepares GST return data accurately. Many even integrate directly with the government GST portal to save you hours every month.

No more manual entry. No more fear of errors.

📈 How It Helps You Grow Your Business

Beyond accounting, cloud-based software helps you see the bigger financial picture.

You can track:

- Monthly sales and expenses

- Pending customer payments

- Overall business growth trends

With these insights, you make smarter financial decisions — like when to expand, hire, or invest in marketing.

💬 Real-Life Example

Let’s say you run a small electronics shop in Delhi. Every month, you create dozens of invoices and collect payments from different customers. Using cloud-based GST software, you can:

- Create and send GST invoices in seconds

- Share them directly on WhatsApp

- Track which customers haven’t paid yet

- Generate monthly sales reports automatically

All without hiring an accountant or worrying about losing your files.

💰 Affordable and Scalable for Every Small Business

Earlier, accounting software was expensive and complicated. But cloud-based GST software has changed that completely.

Today, even a local shop or freelancer can afford professional tools starting from just ₹1,000-₹2,500 per year.

Plus, as your business grows, you can easily add more users, features, or modules — no need to switch systems.

🚀 Final Thoughts

If you’re a small business owner in India, it’s time to leave behind manual ledgers and outdated desktop accounting tools.

A cloud-based GST accounting software gives you flexibility, accuracy, and peace of mind — all at an affordable price.

It helps you stay GST compliant, save time, and focus on what truly matters: growing your business.

So, whether you run a retail shop, freelance business, or startup, make the smart move today.

👉 Try MyBillZone — the simple, cloud-based accounting software built for Indian small businesses.