Goods and Services Tax filing is one of the most important legal responsibilities for businesses operating in India. Whether you are a small business owner, freelancer, startup founder, trader, or service provider, timely and accurate GST filing ensures smooth business operations and protects you from penalties and legal notices.

In this detailed guide, you will learn everything about GST filing in India, including what GST filing is, who needs to file GST returns, types of GST returns, due dates, penalties, common mistakes, and how MyBillZone simplifies GST filing.

What is Goods and Services Tax (GST)?

Goods and Services Tax (GST) is an indirect tax system introduced in India on 1st July 2017. It replaced multiple indirect taxes such as VAT, Service Tax, Excise Duty, and CST with a single unified tax structure.

GST is applicable on the supply of goods and services and is collected by the government at each stage of value addition.

What is Goods and Services Tax Filing?

Goods and Services Tax filing is the process of submitting GST returns to the government by providing details of:

- Sales (outward supplies)

- Purchases (inward supplies)

- Output GST collected

- Input Tax Credit (ITC) claimed

- Net tax payable

Every GST-registered taxpayer must file GST returns monthly, quarterly, or annually, depending on their registration type and turnover.

👉 Important: Even if there is no business activity, filing a Nil GST return is mandatory.

Who is Required to File GST Returns?

GST filing is mandatory for the following:

- GST-registered businesses

- Freelancers and consultants

- Online sellers (Amazon, Flipkart, Meesho, etc.)

- Service providers

- Manufacturers and traders

- Composition scheme taxpayers

- E-commerce operators

- Startups with GST registration

Once registered under GST, return filing becomes compulsory, regardless of turnover or income.

Types of GST Returns in India

Understanding GST return types is crucial for correct GST filing.

1. GSTR-1 (Sales Return)

- Contains details of outward supplies (sales invoices)

- Filed monthly or quarterly

- Used for buyer ITC calculation

2. GSTR-3B (Summary Return)

- Most important GST return

- Summary of sales, purchases, and tax liability

- Filed monthly

- Payment of GST is done through GSTR-3B

3. GSTR-4 (Composition Scheme Return)

- For taxpayers under the composition scheme

- Filed annually

4. GSTR-9 (Annual Return)

- Consolidated annual GST return

- Mandatory for regular taxpayers (subject to limits)

GST Filing Due Dates (Updated)

Timely GST filing helps avoid penalties and interest.

| GST Return | Due Date |

|---|---|

| GSTR-1 | 11th of next month |

| GSTR-3B | 20th of next month |

| GSTR-4 | 30th April |

| GSTR-9 | 31st December |

⚠️ Missing due dates leads to late fees and interest charges.

Penalty for Late GST Filing

Late GST filing can seriously impact your business.

Late Fees:

- ₹50 per day (₹25 CGST + ₹25 SGST)

- ₹20 per day for Nil return

Interest:

- 18% per annum on tax amount

Other Consequences:

- GST registration cancellation

- E-way bill blockage

- Loss of Input Tax Credit

- Legal notices from GST department

- Poor compliance record

👉 Regular GST filing avoids unnecessary stress and financial loss.

Importance of GST Filing for Businesses

GST filing is not just a legal requirement; it is essential for business growth.

Benefits of Proper GST Filing:

- Maintains legal compliance

- Avoids penalties and interest

- Builds trust with clients and vendors

- Enables Input Tax Credit (ITC)

- Helps in bank loans and tenders

- Improves business credibility

Common GST Filing Mistakes to Avoid

Many businesses make avoidable GST filing errors:

❌ Missing GST filing deadlines

❌ Incorrect invoice details

❌ Wrong GST rate application

❌ Not reconciling GSTR-2B

❌ Claiming ineligible ITC

❌ Manual filing without automation

Using the right GST billing software can prevent these mistakes.

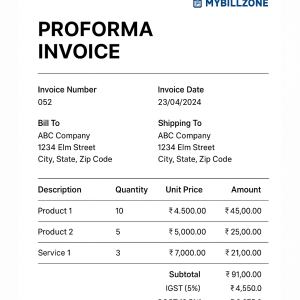

How MyBillZone Makes GST Filing Easy

MyBillZone is an all-in-one billing and GST management software designed for Indian businesses, freelancers, and startups.

Key Features of MyBillZone:

✅ GST-compliant invoice creation

✅ Automatic CGST, SGST & IGST calculation

✅ Accurate invoice numbering

✅ Ready GST data for return filing

✅ Reduces manual errors

✅ Saves time and effort

✅ Ideal for small businesses and freelancers

With MyBillZone, you can manage billing and GST filing from a single dashboard.

GST Filing for Freelancers & Small Businesses

Freelancers and small businesses often struggle with GST compliance. MyBillZone helps by:

- Creating professional GST invoices

- Tracking income and tax liability

- Preparing data for GSTR-1 & GSTR-3B

- Simplifying compliance without accountants

This makes GST filing stress-free even for non-technical users.

Step-by-Step GST Filing Process (Simple Overview)

- Collect sales and purchase invoices

- Verify GST rates and HSN/SAC codes

- Reconcile ITC with GSTR-2B

- Prepare GSTR-1 and GSTR-3B

- Pay GST tax online

- Submit GST return on time

Using MyBillZone automates most of these steps.

Why Choose MyBillZone for GST Filing?

MyBillZone is built keeping Indian compliance needs in mind.

- Beginner-friendly interface

- Accurate tax calculation

- Saves compliance cost

- Suitable for growing businesses

- Helps avoid GST notices

Final Thoughts

Goods and Services Tax filing is a crucial part of running a business in India. Missing GST returns can result in penalties, interest, and legal issues. With the right tool like MyBillZone, GST filing becomes simple, accurate, and time-saving.

If you want a smooth GST compliance journey, start managing your billing and GST with MyBillZone today.