💡 Introduction

If your business is registered under GST, then issuing a GST-compliant bill is not just good practice — it’s mandatory. A proper GST bill format ensures that your invoices follow government rules and help you stay tax-compliant. In this guide, we’ll explain what a GST bill format is, the important elements it must include, and how MyBillZone makes it super easy to create and manage your GST invoices online.

📘 What Is a GST Bill Format?

A GST bill format (or GST invoice format) is the standard structure businesses use to issue invoices for goods or services while charging GST. Every registered business in India must issue this invoice when selling taxable products or services.

The GST bill format helps both the buyer and the seller record the transaction accurately, ensuring transparency and compliance with Indian tax laws.

🧾 Why Is a GST Bill Important?

A GST invoice is the foundation of India’s GST system. It helps the government track the movement of goods and ensures that the right amount of tax is collected. For businesses, it provides a record for:

- Claiming Input Tax Credit (ITC)

- Filing accurate GST returns

- Maintaining clear accounting records

- Avoiding penalties during GST audits

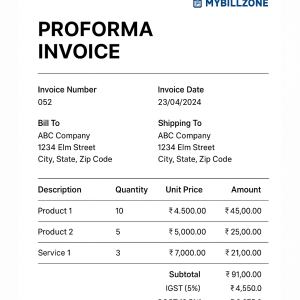

🧰 Mandatory Details in a GST Bill Format

According to GST law, every invoice must contain specific information. A valid GST invoice should include:

- Supplier details – Business name, address, and GSTIN

- Invoice number – A unique, sequential number

- Invoice date – Date of issue

- Buyer details – Name, address, and GSTIN (if registered)

- Description of goods/services

- HSN or SAC code (depending on product/service)

- Quantity and unit

- Rate and value before tax

- CGST, SGST, or IGST amount

- Total invoice value (including tax)

- Authorized signature or digital signature

✅ Tip: Missing any of these details can make your invoice non-compliant under GST law.

💼 Types of GST Bill Formats

Depending on the type of transaction, businesses use different GST invoice formats:

1️⃣ B2B Invoice (Business to Business)

- Issued when the buyer is registered under GST.

- Must include both parties’ GSTIN.

- Necessary for input tax credit claims.

2️⃣ B2C Invoice (Business to Consumer)

- Issued when the buyer is not registered under GST.

- Includes only the seller’s GSTIN and customer details.

3️⃣ Export Invoice

Issued for international customers.

Must mention “Export under bond or LUT without payment of GST” or “Export on payment of IGST”.

📂 GST Bill Format Examples

GST bills can be prepared in multiple formats depending on your preference and tools:

- GST Bill Format in Excel – Easy to customize, best for offline use.

- GST Bill Format in Word – Suitable for businesses who print invoices.

- GST Bill Format in PDF – Most professional and secure, perfect for online billing.

🧮 Download Free GST Bill Format Templates

Creating a GST invoice manually every time can be time-consuming. That’s where MyBillZone comes in.

With MyBillZone, you can:

- Download ready-to-use GST bill format templates (Excel, Word, and PDF).

- Auto-fill tax fields like CGST, SGST, and IGST.

- Save client data for future use.

- Generate unlimited invoices with your logo and signature.

👉 Visit MyBillZone.com and start creating professional GST invoices for free.

🚀 Why Choose MyBillZone for GST Billing?

Here’s why MyBillZone is trusted by small businesses and freelancers across India:

- ✅ 100% GST-compliant invoice formats

- ✅ Automatic GST calculation (CGST, SGST, IGST)

- ✅ Multi-user and multi-business support

- ✅ Easy dashboard to track clients and payments

- ✅ Instant PDF download and email sharing

- ✅ Works smoothly on desktop and mobile

Whether you’re a startup or a small retailer, MyBillZone helps you stay organized, professional, and GST-ready — all in one place.

🧑💻 How to Create a GST Bill on MyBillZone

Follow these simple steps to generate a GST invoice online:

- Visit mybillzone.com

- Choose “Create Invoice”

- Enter seller and buyer details

- Add items, quantity, and price

- Select applicable tax (CGST, SGST, or IGST)

- Click “Generate Invoice” to download your PDF

Your GST-compliant invoice will be ready instantly!

🧾 Common Mistakes to Avoid in GST Invoices

Even small errors can cause compliance issues. Avoid these common mistakes:

- Using duplicate invoice numbers

- Missing GSTIN or HSN code

- Not mentioning tax breakup

- Forgetting to sign the invoice

- Wrongly calculating CGST/SGST percentages

With MyBillZone, these mistakes are automatically avoided thanks to built-in validation and GST logic.

📊 Conclusion

Having a proper GST bill format is essential for every business in India. It ensures compliance, transparency, and easy tax filing. Instead of wasting time creating invoices manually, switch to MyBillZone, India’s best GST invoice generator software.

Generate, manage, and download invoices in just a few clicks — accurate, professional, and 100% GST-ready.

👉 Create your first GST invoice now on MyBillZone.com