The Goods and Services Tax (GST) system has been one of the most significant reforms in India, simplifying taxation and streamlining business compliance. Among all GST returns, GSTR-3B is a critical monthly summary return that every registered taxpayer must file.

From July 2025 onwards, GSTR-3B has undergone important changes aimed at reducing errors, preventing tax leakage, and aligning it closely with GSTR-1 and invoice reporting. Understanding these changes is essential for businesses to stay compliant and avoid penalties.

Why the Change in GSTR-3B?

Earlier, GSTR-3B allowed taxpayers to manually edit auto-populated data from GSTR-1 or invoice reports. While this provided flexibility, it often led to mismatches, incorrect tax reporting, and disputes during audits.

To prevent these issues, the GSTN has introduced non-editable auto-populated fields, stricter reconciliation rules, and tighter timelines for return filing. These changes aim to:

- Ensure data consistency between GSTR-1 and GSTR-3B

- Reduce manual errors in tax reporting

- Streamline Input Tax Credit (ITC) claims

- Strengthen compliance and revenue collection

Major Changes in GSTR-3B 2025

1. Non-Editable Auto-Populated Fields

One of the biggest changes is that certain fields in GSTR-3B, especially in Table 3.2 (tax liability), are now auto-populated from GSTR-1 and cannot be manually edited.

- If you file GSTR-1 incorrectly, the auto-populated figures in GSTR-3B will also reflect those errors.

- To correct such errors, you must use GSTR-1A (amendment form). Direct manual edits in GSTR-3B are no longer allowed.

📌 Impact: Businesses need to ensure accurate GSTR-1 filing to avoid discrepancies and potential penalties.

2. Greater Importance of GSTR-1 and GSTR-1A

With non-editable GSTR-3B fields:

- GSTR-1 filing accuracy becomes critical

- Any correction to outward supplies must go through GSTR-1A before it reflects in GSTR-3B

- Taxpayers must now reconcile invoices carefully before filing GSTR-3B

This ensures that tax liabilities and ITC claims are accurate and aligned with actual transactions.

3. Strict Filing Deadlines

Another major change is the 3-year filing rule:

- Returns older than 3 years cannot be filed on GSTN.

- Businesses must file pending GSTR-3B returns within this timeline to claim Input Tax Credit and avoid penalties.

📌 Tip: Clear all pending returns immediately to prevent blocked ITC claims.

4. Auto-Population of Liability

GSTR-3B now pulls data directly from GSTR-1, GSTR-1A, and Invoice Furnishing Facility (IFF).

- Taxable supplies and tax liabilities are locked and cannot be changed manually.

- Only certain reverse charge transactions or late fee corrections are editable.

This move reduces human error but increases the importance of reconciliation before filing.

5. Impact on Businesses

The new rules mean businesses must:

- Maintain accurate sales and purchase records

- File GSTR-1 on time to ensure auto-populated liability in GSTR-3B is correct

- Regularly reconcile invoices to prevent ITC mismatch

- Educate accounting teams about non-editable fields and auto-population rules

Non-compliance can result in late fees, interest, and blocked ITC claims.

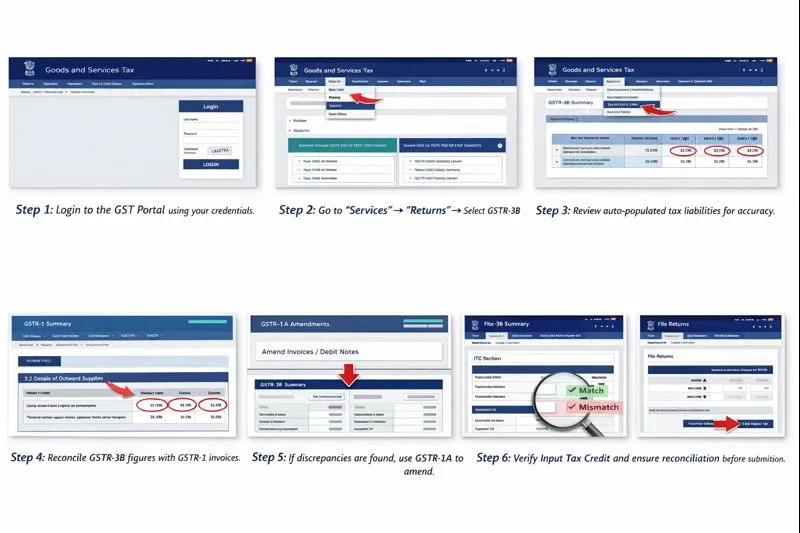

Step-by-Step Filing Guide for New GSTR-3B (2025)

Step 1: Reconcile GSTR-1 and Purchase Records

Ensure all outward supplies and inward supplies match the invoices uploaded.

Step 2: Check Auto-Populated Tax Liability

Login to GSTN portal and verify the auto-filled tax values in Table 3.2.

Step 3: Use GSTR-1A for Corrections

If any errors appear in auto-populated fields, file amendments through GSTR-1A before filing GSTR-3B.

Step 4: Verify ITC Claims

Ensure your Input Tax Credit matches the auto-populated values and reconcile any discrepancies.

Step 5: File GSTR-3B Before Deadline

Submit GSTR-3B with verified and reconciled figures to avoid penalties.

FAQs About New GSTR-3B Changes

Q1: Can I edit auto-populated figures in GSTR-3B?

No, most fields are now non-editable. Corrections must be done via GSTR-1A or invoice amendments.

Q2: What happens if GSTR-1 was filed incorrectly?

Errors will reflect in GSTR-3B. You must amend GSTR-1 using GSTR-1A for the correct data.

Q3: Is there any field in GSTR-3B still editable?

Yes, limited fields such as reverse charge tax liability or late fee adjustments may be manually updated.

Q4: Can I file GSTR-3B for returns older than 3 years?

No, GSTN has blocked filing for returns older than 3 years.

Q5: How to ensure correct ITC claims under new rules?

Regular reconciliation of purchase and sales invoices and accurate GSTR-1 filing are critical.

Conclusion

The GSTR-3B changes of 2025 reflect the government’s focus on accuracy, automation, and compliance. While it reduces manual errors, it also places the onus on businesses to file GSTR-1 accurately, reconcile invoices, and maintain records diligently.

By understanding these changes and adopting a proactive approach, businesses can avoid penalties, maximize Input Tax Credit, and ensure smooth GST compliance.